|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

How to File for Bankruptcy in NJ: A Comprehensive Guide

Filing for bankruptcy in New Jersey can be a complex process, but understanding the steps involved can help simplify it. This guide will walk you through the essential aspects of filing for bankruptcy in NJ, including the types of bankruptcy, the filing process, and important considerations to keep in mind.

Understanding Bankruptcy Types

In New Jersey, individuals typically file for either Chapter 7 or Chapter 13 bankruptcy. Each type has specific requirements and implications.

Chapter 7 Bankruptcy

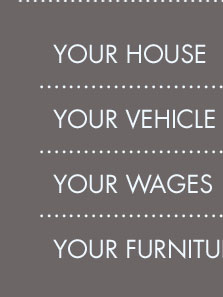

Chapter 7 bankruptcy, often referred to as 'liquidation bankruptcy,' involves the sale of a debtor's non-exempt assets to pay creditors. It's important to note that not all assets are subject to liquidation.

For more details on similar procedures, you can refer to chapter 7 bankruptcy alabama resources.

Chapter 13 Bankruptcy

Chapter 13 bankruptcy allows individuals to keep their property while repaying debts over a period of three to five years. This option is suitable for those with a regular income who can adhere to a repayment plan.

The Filing Process

- Credit Counseling: Before filing, individuals must complete a credit counseling course from an approved provider.

- Prepare Documentation: Gather financial records, including income, expenses, debts, and assets.

- File Petition: Submit the bankruptcy petition along with required forms and fees to the New Jersey Bankruptcy Court.

- Automatic Stay: Once filed, an automatic stay goes into effect, halting most collection activities.

- Meeting of Creditors: Attend a meeting with creditors to discuss financial matters under oath.

- Debt Discharge or Repayment Plan: Depending on the chapter filed, complete asset liquidation or adhere to a repayment plan.

Important Considerations

- Bankruptcy can affect credit scores significantly, so consider financial counseling to understand the long-term impacts.

- Consulting with a bankruptcy attorney can provide valuable guidance and ensure the process complies with NJ laws.

- Explore alternative debt relief options before deciding to file for bankruptcy.

For instance, if you are researching options outside New Jersey, you might find chapter 7 bankruptcy colorado insights helpful.

Frequently Asked Questions

What are the eligibility requirements for Chapter 7 bankruptcy in NJ?

Eligibility for Chapter 7 is determined by the means test, which evaluates income against the state median. If your income is below the median, you may qualify.

How does filing for bankruptcy affect my credit?

Bankruptcy can remain on your credit report for up to 10 years, potentially lowering your credit score and affecting future borrowing ability.

Can I file for bankruptcy without an attorney in NJ?

While it's possible to file without an attorney, professional legal assistance is recommended to navigate complex legal requirements and improve case outcomes.

Although the law allows you to represent yourself in bankruptcy court, you should understand that many people find it extremely difficult to represent ...

Here, you'll find an explanation of Chapters 7 and 13, checklists to help you understand the process and stay organized, and New Jersey's property exemption ...

Home; Collection & Enforcement Activity. Bankruptcy. If you have filed or are considering filing a bankruptcy petition, make sure your ...

![]()